Your credit score tells lenders how big of a financial risk you are. Your score says to potential creditors the probability of you paying back debt accrued. If your score is low in value then the risk is high. In these instances credit is denied. However, if your score is fair to low then creditors may assume the risk is worth your business. There are easy ways to find and interpret your credit score. It’s not as complicated as it may seem.

Step 1

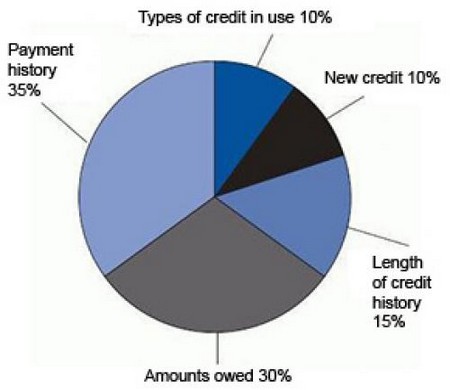

Your credit score consists of five categories. This is how it is calculated overall. There is a percentage attached to every category. Payment history on anything that was credited to you and the amount outstanding are factored in your credit score at 35% and 30% respectively. The time you have established credit is factored in your credit score at 15%. The amount of new credit and type you recently applied for is also factored in. Its value is 10%.

Step 2

Keep up with your current credit score so you will always have an indication of where you stand financially. Request your credit score. This request is available to all consumers every year. You are entitled to receive a free credit report from each of the three credit bureaus annually. For every credit report after request after that there is a fee. Even though you are entitled to a free credit report, you will have to pay for your credit score to come with your credit report. Some creditors report to certain bureaus and do not report to any other bureau. It is possible that each credit bureau will have a different credit score for you because of this. Visit annualcreditreport.com, where you can receive a free credit report from each of the three credit bureaus once a year. You will have to pay for your credit score to accompany the credit reports.

Step 3

Analyze your scores from the three bureaus. If they vary you can generally assume an average score for yourself based on these numbers.

Step 4

Analyze the overall results. There is no regulated chart that will define for you what your score translates to in terms of risk and credit. However, Banks and credit bureaus set ranges that indicated whether your score is considered poor, average, good or excellent. 300-500 is considered to be poor credit. 500-600 is poor but still better. 600-700 is average credit. 700-800 is good credit and above 800 is excellent credit. Find out where you fall.